Canfax

Canfax Cattle Market Update- 2023 in Review

The first half of 2023 was marked by high feed costs but also record high prices. Drought again hit a portion of the Prairies, pushing heifers into feedlots, and delaying herd expansion despite record high calf prices. Feedlots had average margins in the black on the cash market (assuming no risk management) for all weights of cattle. The Canadian dollar was relatively stable throughout the year.

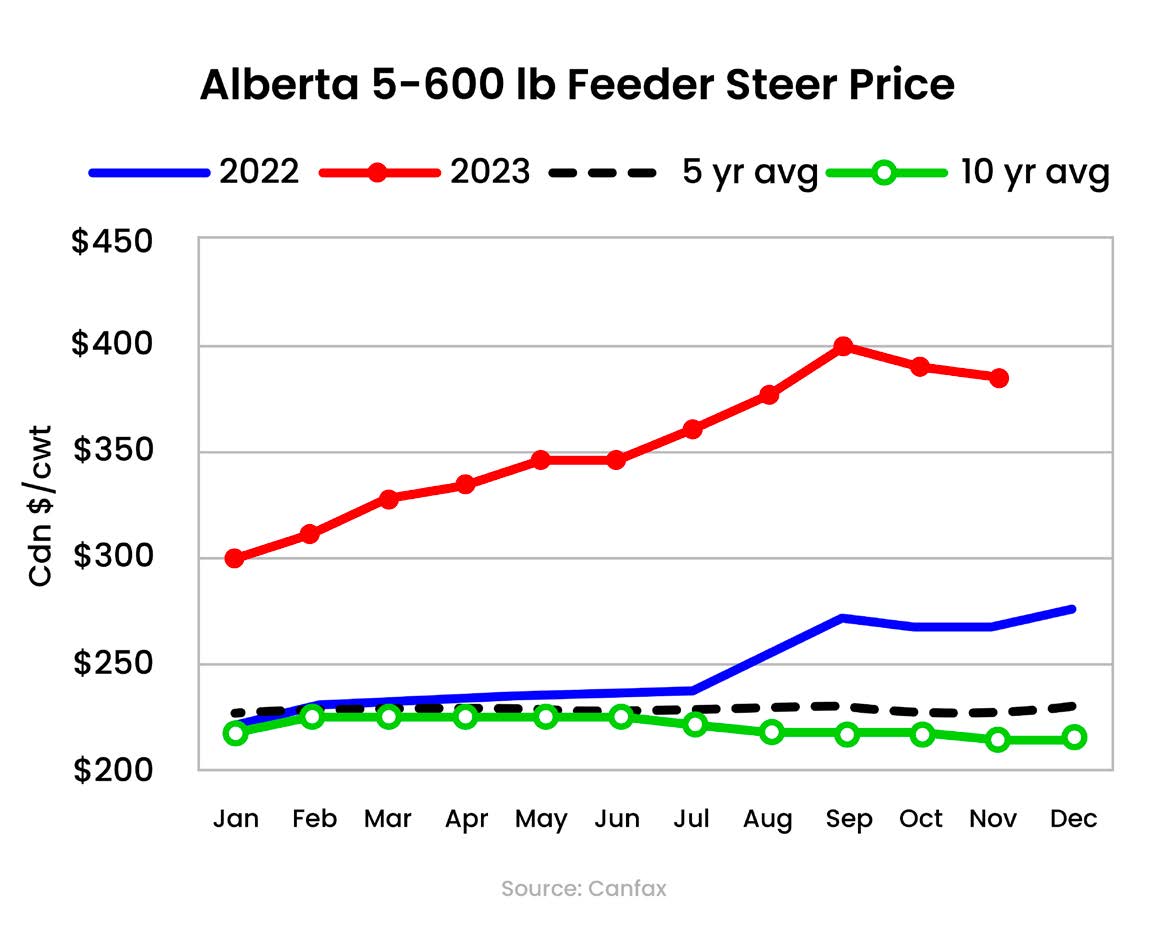

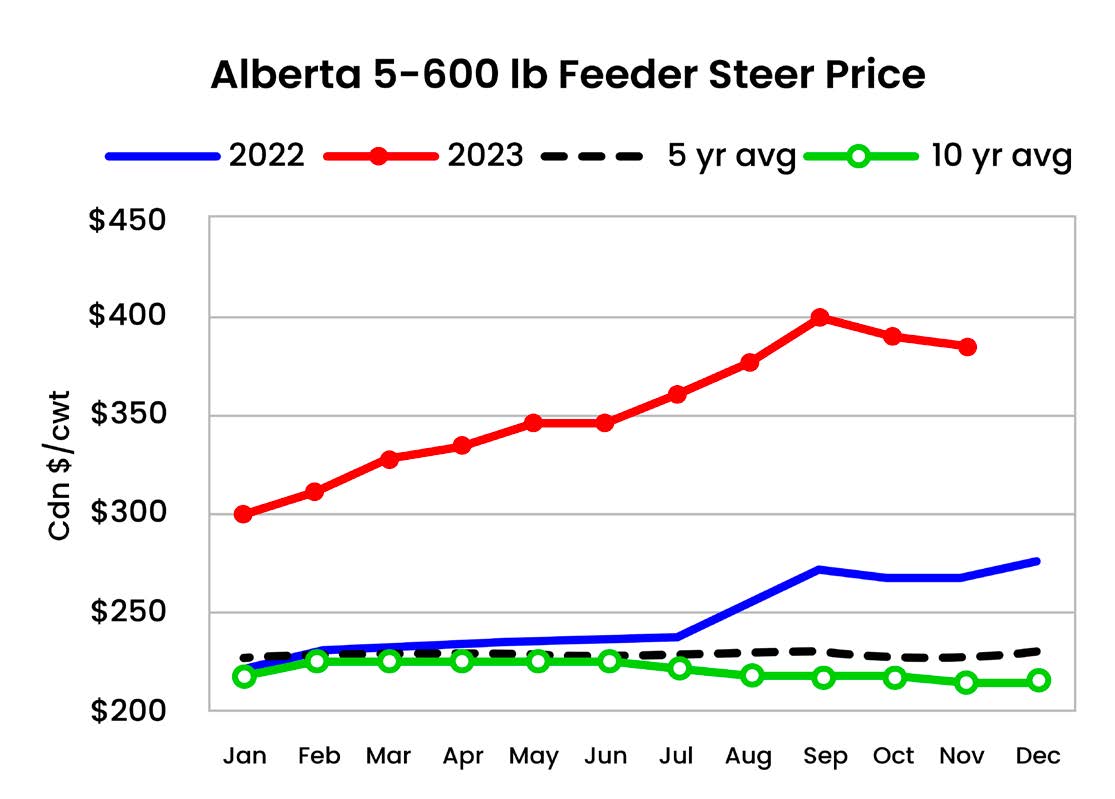

Prices improved for all classes of cattle in 2023, with Alberta 5-600 lb steers averaging $384/cwt in the fourth quarter up $114/cwt or 42% from 2022. Record high calf prices pushed Alberta cow-calf profits to record levels in 2023, surpassing 2015. Alberta fed steer prices were up 19% from January to December, establishing new all-time highs several times this past year. An annual average price of $225/cwt is the highest on record.

For 2023, barley is averaging around $400/tonne, 8% lower than last year, but remains 29% higher than the five-year average. Barley prices were largely steady near $425/tonne in the first half of 2023 but softened 12% in the second half to be closer to $375/tonne. China opened their border to Australian barley in August

after three years of trade restrictions, which reduced demand for Canadian barley, and moved prices lower. For 2023, average hay prices were a moderate 3% lower than last year but were 29% higher than the five-year average. Alberta hay prices moved opposite to barley, increasing 21% from the first half to the second half of 2023, to $250/ton. Alberta hay prices climbed higher this summer as drought conditions once again moved into western Canada, reducing yields. A moderation in feed costs, with larger North American corn production in 2023 supported calf prices this fall.

The U.S. cow herd peaked in 2018 and has declined 9% since. In addition, beef replacement heifers are down 700,000 head since the 2016 peak. The 2023 calf crop was 665,000 head smaller than 2022, or down 1.9%. Herd rebuilding was expected to begin this past summer, however, drought conditions which settled into many of the grazing states discouraged heifer retention this fall. Historically high calf prices should encourage herd rebuilding next year, though significant changes in inventories will be dependent on moisture and feed stocks. U.S.D.A. is projecting beef production to decline 3-5% in 2024 with a larger drop occurring in the second half. The reduction in supplies is expected to support prices in 2024.

But prices are made up of both supply and demand. Nominal retail beef prices in 2023 (January to October) increased 7% from 2022. In comparison, retail chicken prices only increased 3% while retail pork prices decreased 5%. This pushed both the beef-to-pork and beef-to-chicken price ratios historically wide in 2023. Despite economic headwinds in 2023, including the threat of recession in the second half of the year, demand remained historically strong.

Factors to Watch in 2024

There are many moving parts to cattle markets. Any black swan event like a major supply chain disruption would likely trump all of the other market factors listed below.

Demand – Beef demand is expected to be under pressure in 2024 with the average Canadian family estimated to pay an additional $700 for groceries due to sticky food price inflation.

International demand has shown signs of cracking. Ample stocks in some Asian countries have kept their beef prices low, pricing North American beef out of those markets. We continue to see remarkable support in North America, particularly for high quality AAA and Prime beef.

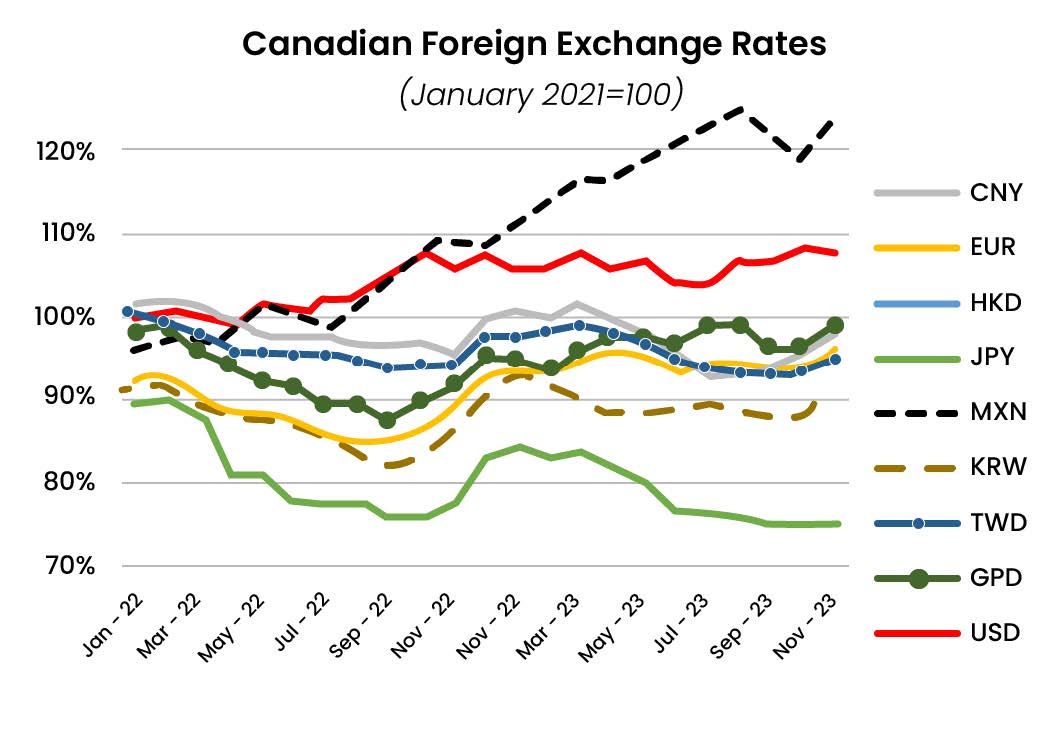

The U.S. Dollar and the Mexican Peso continue to perform well against the Canadian Dollar. A strong currency makes imports more attractive; this has shifted international trade away from Japan and towards Mexico in 2023. Exchange rates will continue to play a large role in the destination of Canadian beef in 2024.

Weather – U.S. cattle markets are projected to decline next year, which is anticipated to support higher

prices. Dry conditions in the summer of 2023 pushed feeders into feedlots early which will support production in the first quarter of 2024. Moisture conditions are anticipated to improve in the first half of 2024 and may encourage heifer retention in the second half. Markets are expected to be down in 2024 but will see a steeper drop if heifers are retained.

Feed grains – Lethbridge barley remains at a feed cost disadvantage to Ontario and Nebraska corn. There is potential for a big swing in the feeder market if the U.S. gets sufficient rain.

Canadian dollar – Except for a small spike in the summer, the Canadian dollar has been largely range bound between $0.73-0.75 this year and is set to average near $0.74. A one cent change in the Canadian dollar impacts calf prices by about $6/cwt, holding all other variables constant. The stability in the Canadian dollar allowed supply and demand fundamentals to work through the marketplace.

Basis levels strengthened in the fourth quarter of 2023, as the futures market dropped. December 1st 2023 Alberta and Saskatchewan cattle on feed numbers were steady with last year, and 4% larger than the five-year average.

This could add basis risk for feedlots, particularly in the first quarter. The monthly Canfax Trends report estimates that all classes of feeder cattle had positive average net margins in 2023, assuming no risk management. Positive feedlot margins encouraged feedlots to fill pens. From January to October, net feeder imports totalled 136,700 head, 106% higher than 2022 and only 2% below the five-year average. Relative supply and demand, north and south of the border is the key driver of basis levels. How many fed cattle end up going south will be an important driver for basis levels and feedlot leverage in 2024.

Canfax is Canada’s go-to source for cattle market information. A division of the Canadian Cattle Association, Canfax has provided expert analysis of markets and trends in the ever changing North American beef industry for over 50 years. Cattlemen, feedlot managers and agri-business professionals rely on accurate, relevant and timely information as an essential tool for maximizing profit in today’s beef sector. To learn how to become a Canfax member for ongoing daily/weekly market information visit: www.canfax.ca